Download Volume 5, Issue 11 of The Risk Report In this Edition: Chronic Conditions Driving Healthcare Costs Show Your Staff How to Best Use Their HSA Plans Help Younger Workers Understand Their Coverage More Employers Offering Deductible-Free Plans Download the...

Optometrist

EEOC Ramping Up Workplace Anti-Discrimination Efforts

Employers should brace for increased enforcement by the U.S. Equal Employment Opportunity Commission after it received a budget boost and has a new board member, breaking a deadlock that's been going on for nearly a year. Here's the latest EEOC news that's pointing to...

More Employers Offering Deductible-Free Plans

As more Americans struggle with medical costs and rising out-of-pocket expenses, more employers are starting to offer deductible-free plans, according to a new report. Mercer's "2023-2024 Inside Employees' Minds" survey results jibe with other reports that some...

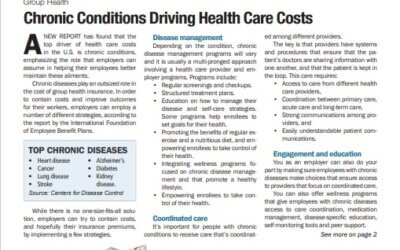

Chronic Conditions Driving Health Care Costs

A new report has found that the top driver of health care costs in the U.S. is chronic conditions, emphasizing the role that employers can assume in helping their employees better maintain these ailments. Chronic diseases are a major strain on the health care system,...

The Shifting PBM Landscape

As we approach January 1st, many employers are yet again seeing increases to the cost of their health plan - an all too familiar product of a health insurance model that isn’t working for consumers. Time and again, we’ve seen costs rise for plan participants without...

Open Enrollment: Help Younger Workers Understand Their Coverage

A new study's findings that many workers have a poor understanding of their employer-sponsored health insurance benefits, presents an opportunity for businesses to extend targeted support to staff during open enrollment. The "2023 Optavise Healthcare Literacy...

Retaliation Accounts for 35% of All EEOC Complaints

The Equal Employment Opportunity Commission is seeing a wave of retaliation complaints by employees. Retaliation charges accounted for more than 35% of all charges filed with the commission in fiscal year 2022. Retaliation means any adverse action that you or someone...

How to Handle Spousal Coverage for Your Staff

While the Affordable Care Act requires employers to offer coverage for employees’ adult children until the age of 26, it does not require them to offer coverage to their workers’ spouses. As employers try to balance the costs of offering health coverage, spousal...

The Risk Report – October 2023

Download Volume 5, Issue 10 of The Risk Report In this Edition: Get an Early Start on Open Enrollment Diabetes Programs Can Boost Productivity, Reduce Costs Stop-Loss Insurance Rates Rise as Catastrophic Claims Grow More Providers Charge for Telemedicine, Doctor...

The Beacon – October 10, 2023

MZQ Beacon Alert - October 10, 2023 In this Edition: "The Internal Revenue Service (IRS) recently released draft instructions for preparing, distributing, and filing 2023 Forms 1094-B/C and 1095 B/C. These instructions largely mirror guidance the IRS has published in...