As you’ve likely seen, either from us or in the news, on June 17th Spectrum Health and Beaumont announced a proposed merger of equals. Since that time, some opposition to the merger has started to go public. First, the statewide business-labor coalition Economic Alliance for Michigan, went public with concerns over the size of the new entity when the merger is complete. Ultimately the concern is driven by the expectation that the merger will not result in lower costs, but that it will drive-up costs as studies have shown.

More notably was the open letter written to the Spectrum Health Board by former Spectrum CFO and CEO of Spectrum owned Priority Health, Michael Freed. His letter has received quite a lot of press, and if you haven’t read it you should spend 10 minutes doing so. You can find his letter here. While Freed left Spectrum in 2013 and his role as CEO of Priority Health in January of 2016, there are few people more qualified to weigh in on this topic than he is. He raises several very good questions in his letter and proposes a path forward that maximizes the benefit to West Michigan should the merger be consummated.

One of the most eye-opening aspects of his letter was his comments related to Priority Health, an insurer many of the employers we interact with use. Here are the key areas we believe needs more attention:

“Priority Health had a book value of $1.315 billion as of 3/31/2021, the last financial statements publicly available. Per the financial statements, that represented risk-based capital (RBC) of 642%. RBC, per the NAIC, is defined as the minimum amount of capital (equity) appropriate for an insurer to support its overall business operations in consideration of its size and risk profile. So, Priority Health has 6.6 times the equity necessary to cover its risk profile. When I was President & CEO of Priority Health, we moved RBC from @ 250% to 400%. I used to comment that I could run Priority Health all day at 400% RBC. The difference between 400% and the current 642% is @ $495 million if my math is correct.”

With commercial insurance members representing 503,157 of the 1,075,478 total membership for Priority Health, employers and employees who pay the premiums need to ask themselves how much is enough? At what point does your contribution to the reserves of a non-profit insurer reach a point that is excessive?

My overall point is that this merger will be transformational for health care in Michigan, for better or worse, and employers must ask and seek meaningful answers to many questions on behalf of their employees and their businesses. The Board of Spectrum is made up of very smart, caring individuals, some of whom I know and have great respect for. I am confident that they truly believe that this merger is in the best interest of Spectrum, but the broader question should be is this in best interest of the various communities these systems serve? Here are key questions that should be asked and answered prior to the merger moving ahead:

Why?

In the letter of intent released by Spectrum and Beaumont, the stated justification for the merger is:

The Parties are undertaking this Integration to develop a permanent organization that will effectively and efficiently integrate health care services and health care coverage to: (1) improve health, health access, and health equity; (2) enhance consumer experience; (3) improve the quality, value, and outcomes of health care; (4) make health care more affordable for the communities we serve; and (5) ensure the voices of team members and physicians are heard.

Some have criticized the letter of intent of being so generic and rosy that if any other parties were involved you’d only need to change the names and the rest could remain the same. I have to say that I agree and that more detail is needed. Specifically:

- How will this lead to improved health (as defined by what?)

- How will this increase access to health care?

- How will this improve health equity?

- How this will enhance the consumer experience, in a quantifiable and meaningful way?

- How will it improve quality, value, and outcomes of health care? Today Priority Health already offers narrow network health plans with both Spectrum and Beaumont health systems at the preferred tier. Is it logical to think that the best possible providers in either market reside only at those facilities? Why not build a preferred network based upon objective outcome data regardless of where the provider hangs their hat?

- How will this make health care more affordable for the communities served? The same was said during the merger efforts between Blodgett and Butterworth hospitals in 1996/97 that created Spectrum Health, and today in many cases Spectrum Health is the most expensive option in their market. Not to mention that payers like BCBS have to pay Spectrum more than competitors due to the leverage created by Priority Health. Do we expect this to change post merger?

From my perspective, the answer to the why question is very simple. The health care arms race and the avoidance of which that was used to justify the creation of Spectrum Health, is alive and well today. In reality, while Spectrum Health appears to be the 800lb gorilla in their market, it actually isn’t. Mercy Health St. Mary’s is owned by Trinty Health with 92 hospitals in 22 states and it employs 119,000 people. Metro Hospital merged with the University of Michigan health system, which has 30,000 employees to 31,000 at Spectrum.

When we talk to employers about how to reduce health care costs, we boil it down to two simple things.

Buy less

Pay less for what you buy

For a health care system then, the exact opposite is true. If they can keep leakage to a minimum and get reimbursed higher amounts for each service, they make more money. This merger will allow Beaumont and Spectrum to do both, and when you add to it that you are collecting the premiums (Priority Health) and then paying yourself it is an attractive model.

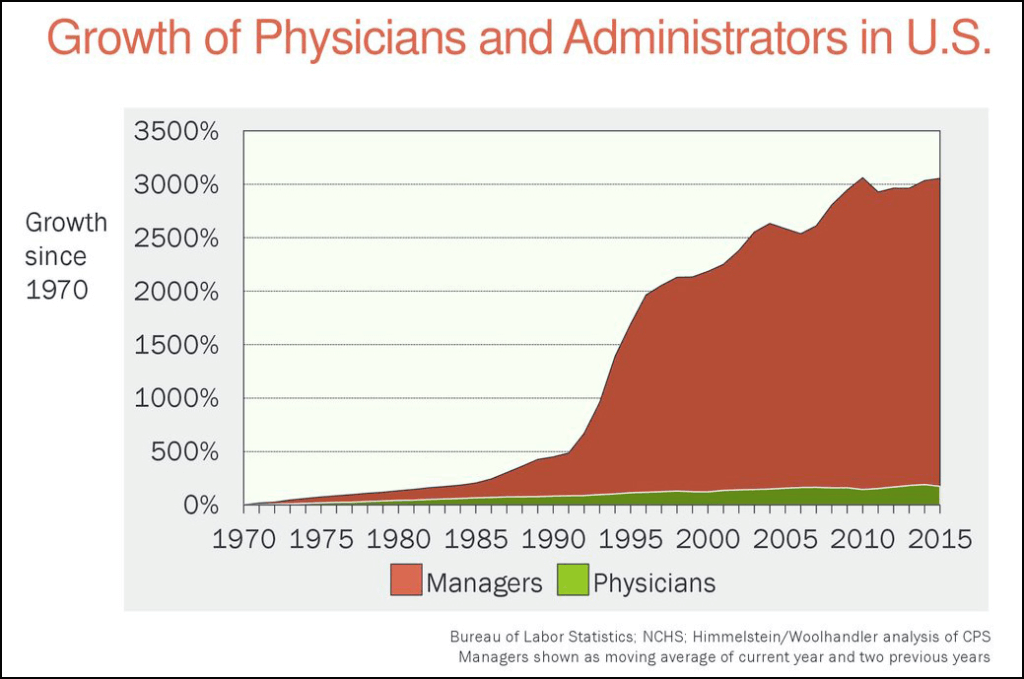

While this will benefit the new joint entity, it very likely will not benefit the people who pay for it. With relatively few exceptions, employees see their insurance premiums increase each year while at the same time seeing their portion of a growing liability (health care costs) increase as well. This is not a sustainable course and non-stop growth of health systems is key contributing factor. When marking the 20-year anniversary of Spectrum Health in September of 2017, the health system employed 25,500 employees. Less than four years later, 5,500 more employees have been added. As I pointed out previously, the merger is not expected to eliminate many jobs, so that will not be the answer to the question about making health care more affordable and it absolutely should be. While I understand that the elimination of jobs is painful and not one to be taken lightly, the current method of financing health care is more painful and eroding the creation of wealth for those at the bottom and middle of the income spectrum. It is not sustainable, as the chart below does a great job of illustrating.

The fact that an industry has sprung up and is growing rapidly to help people finance their health care expenses is a very clear sign that we are headed in the wrong direction.

Finally, as the questions outlined above get answered we should add one more to the list. Rather than follow the national trend of merger after merger, with no meaningful changes in cost and quality to speak of, should Spectrum use their unique position in West Michigan along with their insurance plan to reinvent how health care is delivered and financed? What if Spectrum moved away from the fee for service model, fully understood their costs, published objective quality and outcome data, and made a commitment to reinvent how health care is delivered and paid for. It would be far more difficult than the proposed merger would be, but the results would be transformational for Michigan and the U.S. I believe a community as innovative as West Michigan is up to the challenge.