Understanding the Problem

Let’s Talk Price

HOW TO REDUCE HEALTH INSURANCE COSTS

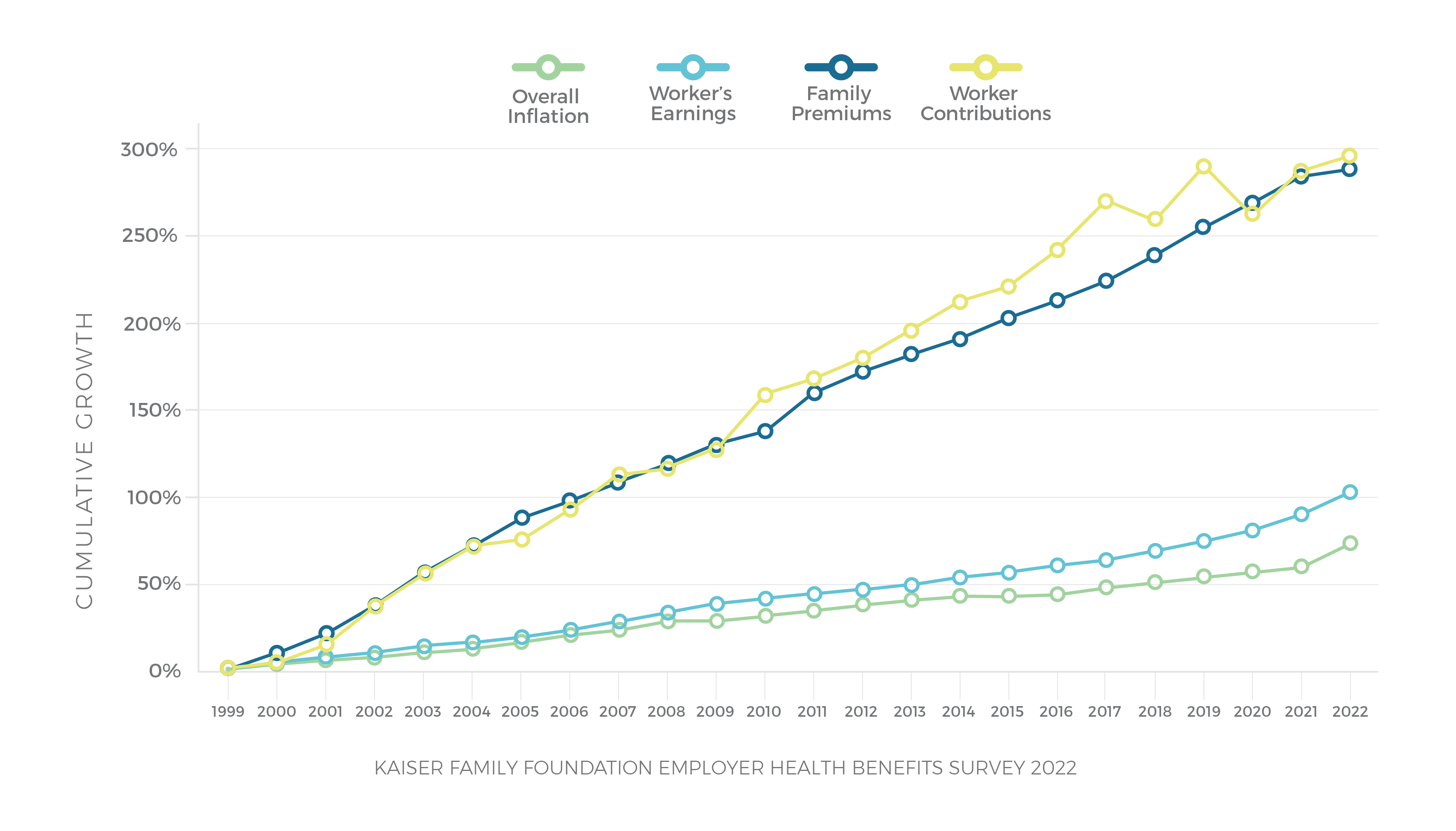

Health insurance rates are rising at an unsustainable pace, and workers are picking up an increasing share of this. Why do employers and employees tolerate this?

The health care and health insurance industries are in a feedback loop, reinforcing the idea that health care gets more expensive each year and so must health insurance. The price keeps going up but no one addresses it, and nothing employers try – from plan changes, employee engagement to wellness programs – makes any real impact.

What is Health Insurance, Really?

At the most basic level, health insurance is a form of risk management. Employers pay insurers a premium to take on their risk in exchange for compensation in the event of a covered loss. In the case of health insurance, insurers manage the health care supply chain and connect employers and end users with different care options.

So, what’s the problem?

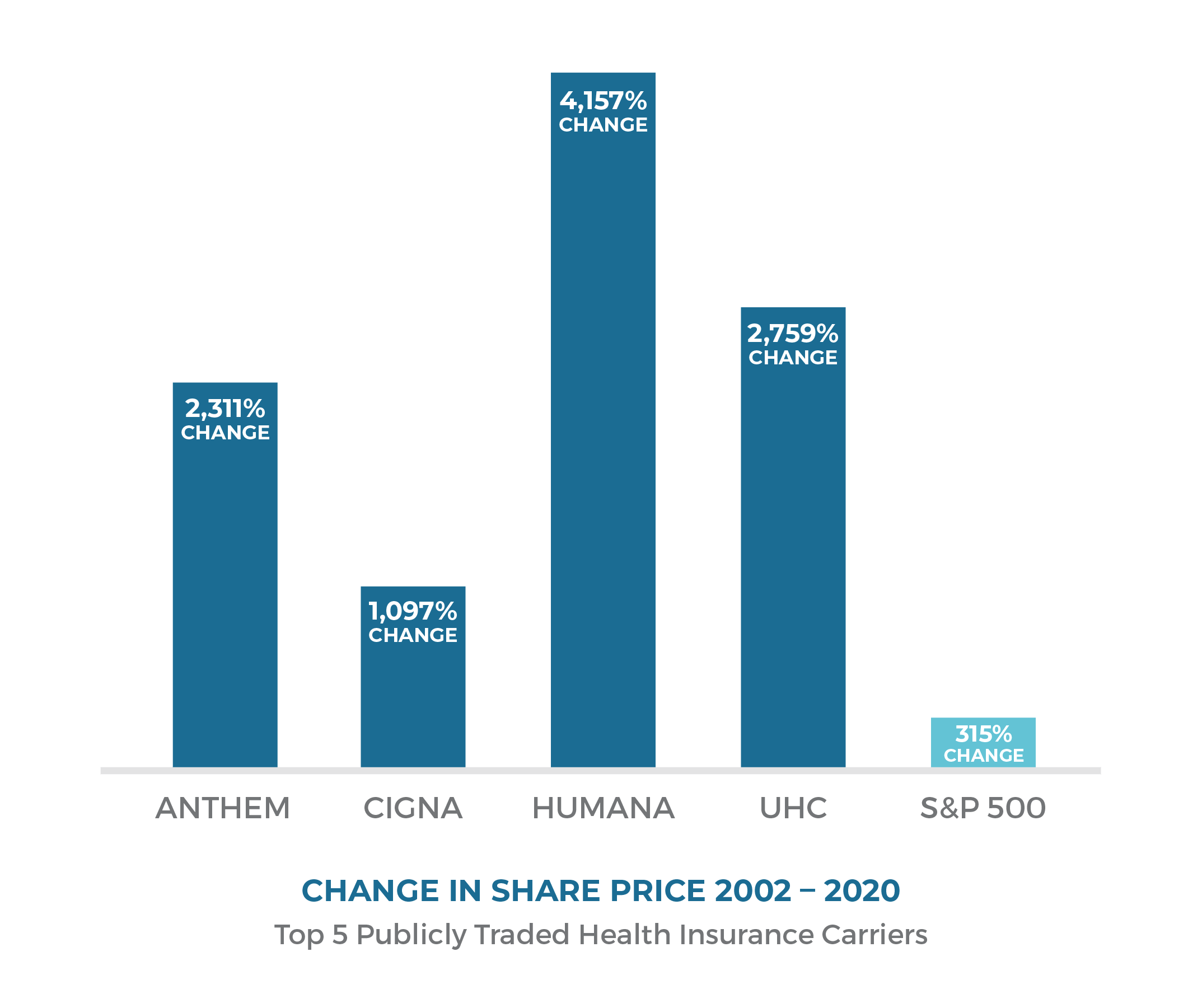

When you review all aspects of the health care supply chain, it’s clear the only players who don’t benefit from rising costs are the ratepayers and end users. Insurance companies, PBMs and others are collecting exponential profits that far surpass the rise of wages and inflation.

It’s a Business

Insurers are businesses, accountable to shareholders. By outsourcing management of the health care supply chain to insurance carriers, employers have lost complete control and the result is a system full of misaligned incentives that reward increasing costs.

The majority of health plans are built around the premise of the network discount where the focus is on the size of the discount off of billed charges rather than the actual price paid for the service, creating an arrangement that benefits both carriers and providers when costs go up.

Higher billed charges allow for bigger “discounts” while the actual price paid steadily increases.

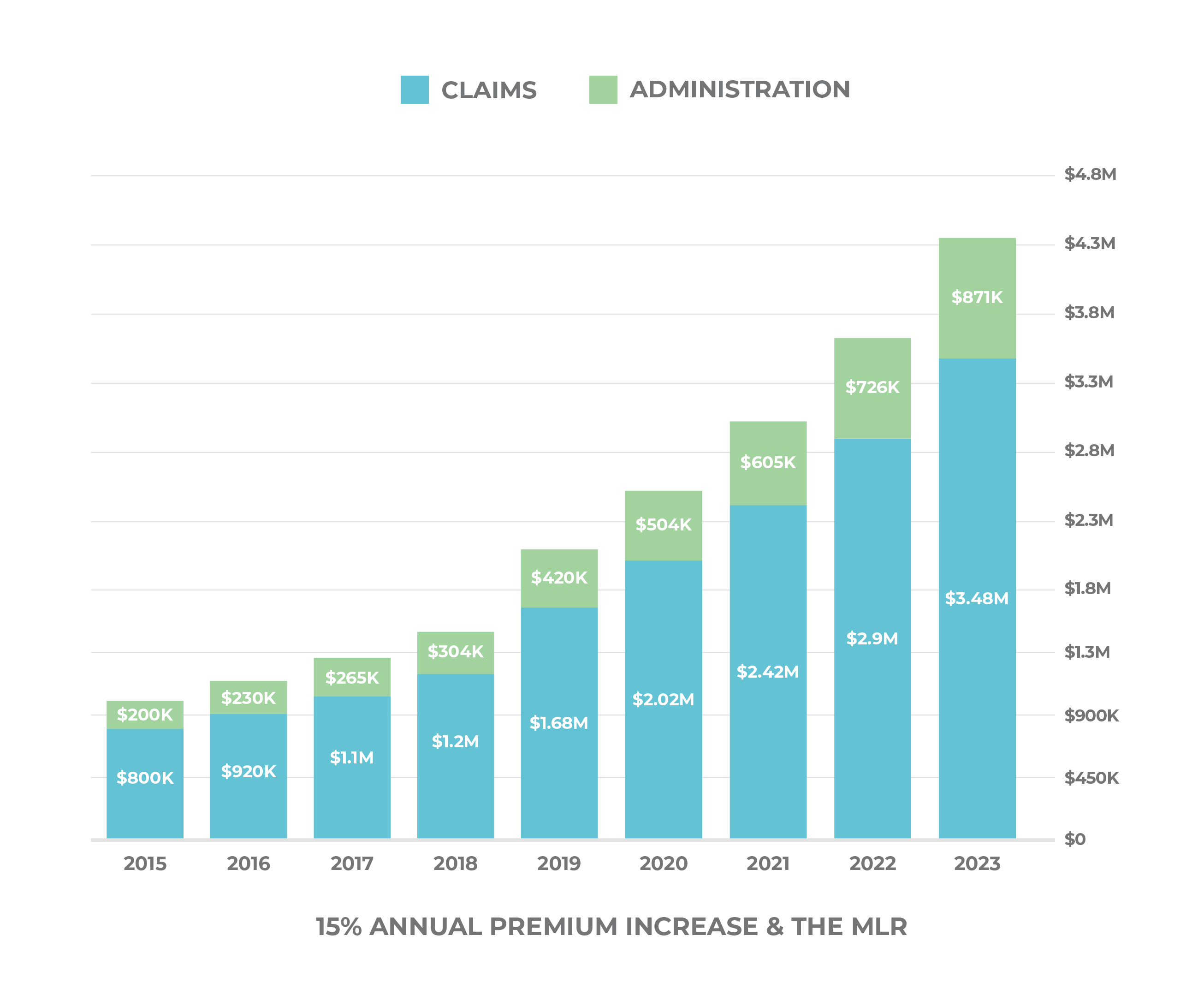

What is MLR?

MLR, or Medical Loss Ratio, is a prime example of misaligned incentives in the health care supply chain. The Medical Loss Ratio is a provision in the Affordable Care Act that was intended to keep insurance carriers from overcharging their customers.

It requires that carriers spend $.80 of each dollar collected in the small group market, and $.85 of each dollar collected in the large group market, to pay its customers’ medical claims and activities that improve the quality of care. The remaining portion can be used for overhead expenses, such as marketing, profits, salaries, administrative costs, and agent commissions.

If health care costs go up, however, then the carrier is justified in charging higher premiums increasing the value of their 15% or 20%. With a model like this, carriers benefit when health care costs go up.

Enough about the Problem; What’s the Solution?

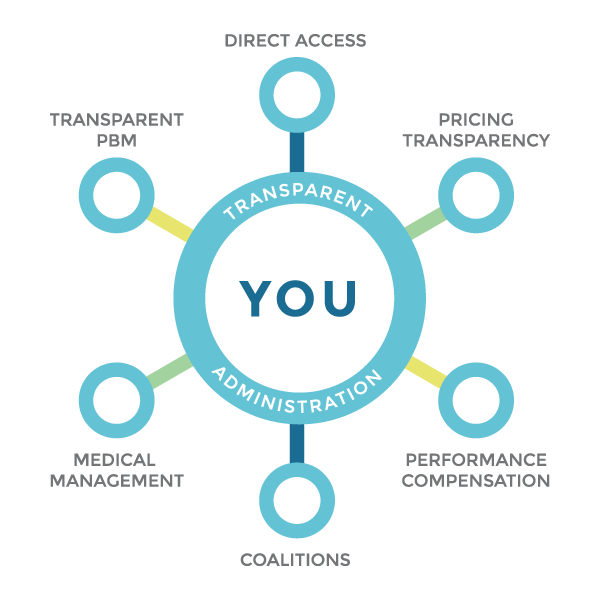

Total Control Health Plans

Total Control Health Plans give employers the ability to manage the healthcare supply chain and take back control so that they no longer are outsourcing the management of one of their largest cost centers.

Employers can directly influence the price of various medical service categories and rely on trusted partners who transparently and effectively manage each category of care. As a result, many companies experience savings of 20% or more after implementing a Total Control Health Plan, which is then sustained consistently year over year.

Dig in Deeper: Download a Free eBook Chapter

Chapter 10 of Not Rocket Surgery: Brokers Haven’t Influenced Price

Start a Conversation

Let’s have a conversation on our dime to see if a Total Control Health Plan will meet your business or organization’s goals.

Contact us to schedule a free consultation today.

Total Control Health Plans

(616) 344-6606

148 S River Ave Ste 300, Holland, MI 49423

Total Control Health Plans

(616) 344-6606

148 S River Ave Ste 300, Holland, MI 49423

What is MLR?

MLR, or Medical Loss Ratio, is a prime example of misaligned incentives in the health care supply chain. The Medical Loss Ratio is a provision in the Affordable Care Act that was intended to keep insurance carriers from over charging their customers. It requires that carriers spend $.80 of each dollar collected in the small group market, and $.85 of each dollar collected in the large group market, to pay its customers’ medical claims and activities that improve the quality of care. The remaining portion can be used for overhead expenses, such as marketing, profits, salaries, administrative costs, and agent commissions. If health care costs go up, however, then the carrier is justified in charging higher premiums increasing the value of their 15% or 20%. With a model like this, carriers benefit when health care costs go up.