The IRS has announced slightly higher health savings account contribution limits for 2026, with the amount increasing 2.3% for individual HSA plans. The IRS updates this amount annually, along with...

The IRS has announced slightly higher health savings account contribution limits for 2026, with the amount increasing 2.3% for individual HSA plans. The IRS updates this amount annually, along with...

The IRS has announced significantly higher health savings account contribution limits for 2025, with the amount increasing 3.6% for individual HSA plans. The IRS updates this amount annually, along...

The IRS has raised the maximum amount employees can funnel into their health savings accounts by 7.8% for 2024, the largest increase ever, brought to you by inflation. The IRS updates this amount...

Employers offer flexible savings accounts and health savings accounts to their employees so they can build up funds with pre-tax dollars to pay for health care and related expenses. For the most...

Download Volume 5, Issue 2 of The Risk Report In this Edition: Ways to help your workers with health care costs Employer-Sponsored Plan 'Family Glitch" Fixed Benefits of Centers of Excellence Why...

Download Volume 5, Issue 1 of The Risk Report In this Edition: 2023 Enhanced Benefits Extra Benefits Valued by Employees Providers Charging for Health Portal Services HR Considerations for Worker's...

Americans are eligible to sign up for Medicare when they turn 65, but more of us are staying in the workforce longer than ever before. In fact, the average retirement age has increased three years...

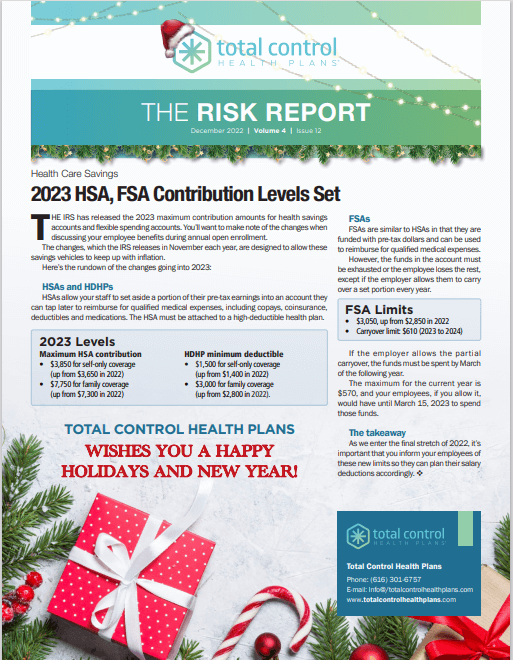

Download Volume 4, Issue 12 of The Risk Report In this Edition: 2023 HSA/FSA Contribution Levels Narrow Networks Premium Reimbursement Plans New Law and Surprise Medical Bills Download the...

The IRS has announced significantly higher health savings account contribution limits for 2023, with the amount increasing more than 5% for individual HSA plans. The new limits were announced in...

Employers looking for ways to decrease their group health insurance outlays over the past decade have been turning to high-deductible health plans as they offer lower up-front premiums. In 2021, 51%...

The IRS has set the maximum amounts employees can funnel into their health savings accounts and health reimbursement accounts (HRAs) for the 2022 policy year. The IRS updates these amounts every...

One of the main recommendations for employees with 401(k) plans is that they should contribute at least enough to their plan every paycheck to ensure they receive the maximum they can in their...

Let’s have a conversation on our dime to see if a Total Control Health Plan will meet your business or organization’s goals.

Contact us to schedule a free consultation today.