As a business leader, you’re accustomed to managing every aspect of your company. From clients to carpet colors, you’re used to being the final say in every decision. While every detail of your office is usually planned to perfection, can the same be said about your health insurance and prescription (Rx) benefits? New clients often have a lot of uncertainty about what happens behind the scenes between their health care providers and the pharmacy benefits managers, and we’re here to clear the air.

What is a Pharmacy Benefits Manager?

Many healthcare plans don’t offer transparency about the decisions they’re making for your employees. Pharmacy benefit managers, or PBMs, transfer prescription drugs between pharmacies and healthcare plans. They also negotiate drug pricing and rebates on behalf of insurers.

A cloud of controversy surrounds PBMs. The Commonwealth Fund delves into this debate, saying:

“The federal Centers for Medicare and Medicaid Services found that PBMs’ ability to negotiate larger rebates from manufacturers has helped lower drug prices and slow the growth of drug spending over the last three years. But PBMs may also have an incentive to favor high-priced drugs over drugs that are more cost-effective. Because they often receive rebates that are calculated as a percentage of the manufacturer’s list price, PBMs receive a larger rebate for expensive drugs than they do for ones that may provide better value at a lower cost.”

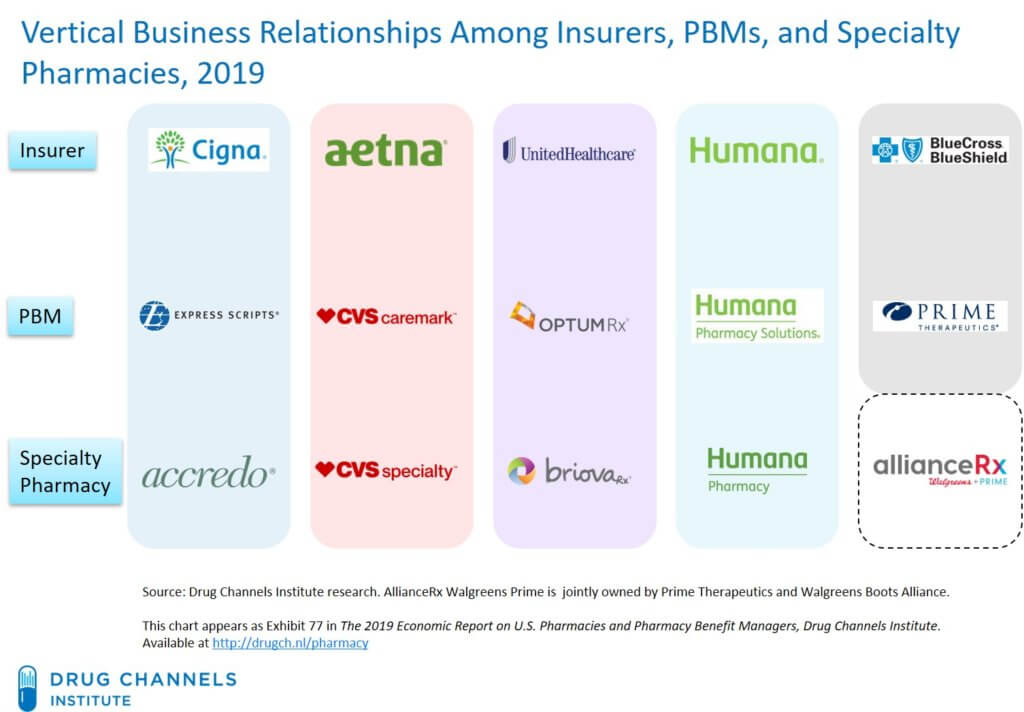

While there are definitely some more fiduciary-minded PBMs that can serve as valuable partners, the larger PBMs often don’t have your best interests in mind. In fact, some of the largest commercial health insurance companies also own large PBMs, an alignment that drives up the cost of your healthcare plan.

The Positive Side of PBMs

Even against the opposition of ever-increasing healthcare costs, we’ve found a way to make PBMs work for you, not against you.

The first place to look when unpacking a healthcare plan is prescription drugs. Why? Because they’re essentially a commodity that gets more expensive every year.

TCHP recently worked with a manufacturer that was spending over a half million dollars a year on prescription drugs alone. Once we aligned with a private PBM, they were able to help us obtain some of the highest-cost drugs for free through programs that large PBMs refuse to participate in.

There may be very expensive claims driving a huge portion of your health benefit costs that go overlooked for years. If your business is paying for these claims, you deserve to have the opportunity to take a closer look at how they’re sourced. You can often find savings without compromising the quality of care for your team.

Get Started Today

If your organization has low transparency and heavy Rx costs driving your healthcare expenses up each year, Total Control Health Plans can help you find clarity and savings by restructuring your health plan. Contact our team to get started on your road to health.