MZQ Beacon Alert – October 19, 2022

In this Edition:

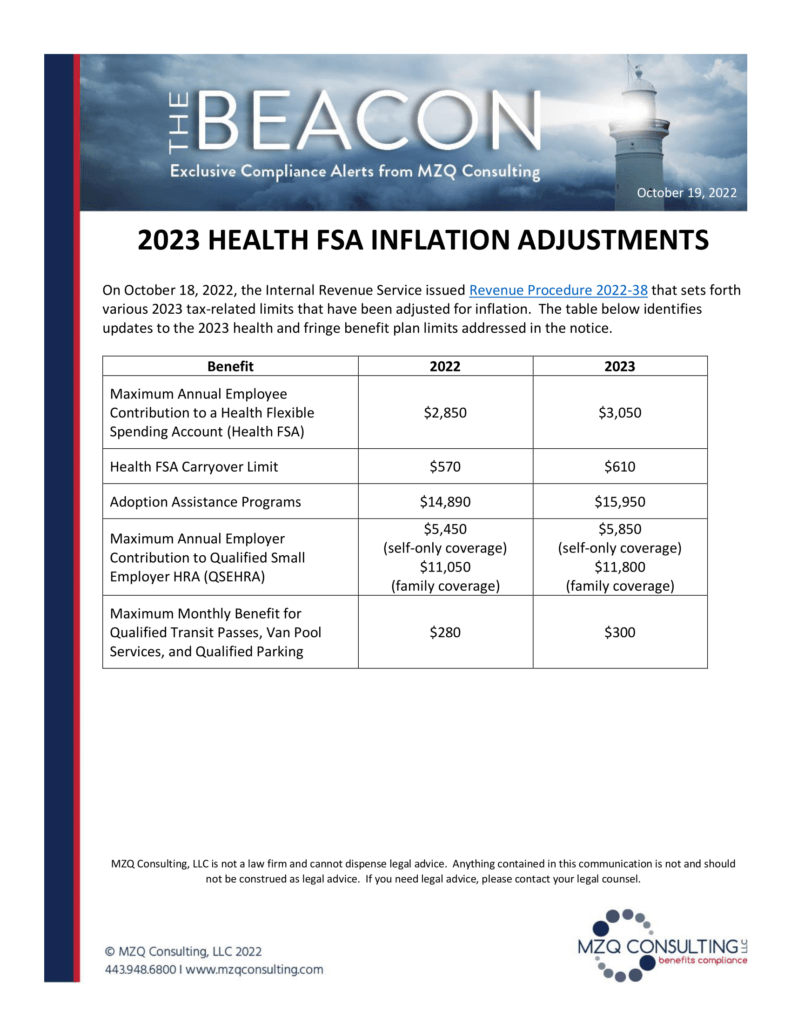

On October 18, 2022, the Internal Revenue Service issued Revenue Procedure 2022-38 that sets forth

various 2023 tax-related limits that have been adjusted for inflation. The table below identifies

updates to the 2023 health and fringe benefit plan limits addressed in the notice.