Every year employees across the country choose the wrong group health plan from their employer because they don't understand the coverage and what type of plan is best for their circumstances. This ends up costing them hundreds if not thousands of dollars in...

HDHP

Voluntary Benefits Demand Surges as Employees Seek to Defray Costs

Sales of voluntary group benefits grew at a record pace in 2023 as more employers expand their offerings and demand continues booming as employees seek out benefits that can defray costs, according to new research. Premiums collected for employer-sponsored voluntary...

New Fiduciary Rule Affects Employers That Offer HSAs

The Department of Labor's new fiduciary rule, which mainly applies to 401(k) plans, will also affect employers who offer their staff health savings accounts. The new rule, which takes effect September 2024, bars employers from providing advice to their workers on how...

Gen Z Workers Go for HDHPs, but Don’t Forget Your Other Employees

While the number of U.S. workers choosing high-deductible health plans has leveled off during the last two years, uptake has been growing rapidly among one segment of the working population: Gen Z employees. The 2024 "State of Employee Benefits Report" by benefits...

Addictions Are Rising Among Workers; What Employers Can Do

According to a study by the Substance Abuse and Mental Health Services Administration, 10% of America’s workers are dependent on one substance or another. The nation is still battling the biggest drug scourge: opioid and fentanyl. Provisional data from CDC's National...

HRA Gym Cost Reimbursement? Not So Fast Says IRS

The IRS has issued a new bulletin, reminding Americans that funds in tax-advantaged medical savings accounts cannot be used to pay for general health and wellness expenses. The bulletin focuses on medical savings accounts that employers will often sponsor, including...

2025 HSA Contribution, HDHP Cost-Sharing Limits

The IRS has announced significantly higher health savings account contribution limits for 2025, with the amount increasing 3.6% for individual HSA plans. The IRS updates this amount annually, along with minimum deductibles as well as the out-of-pocket maximums for...

Worker Enrollment in High-Deductible Health Plans Falls

After enrollment in HDHP soared during the last decade, 2022 marked the first year that enrollment in these plans fell among American workers.

Interest in Health Premium Reimbursement Accounts Grows

Employer adoption of specialized accounts that they fund to help reimburse employees when they buy health insurance on their own is surging in 2024. The number of employers who offer individual coverage health reimbursement accounts (ICHRAs) grew 30% in 2024 from the...

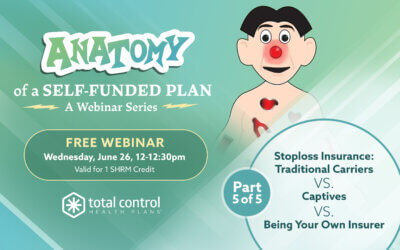

Join Us For “Anatomy of a Self-Funded Plan: Stoploss”

Part 5 of our 5 Part Webinar Series Join us for a Free Webinar on Wednesday, June 26th from 12-12:30pm SHRM Credit Available Register Now As more and more employers consider self-funding as the preferred model for their health plan, we felt it was important to review...