Featured & Video

What’s in Store for 2025? – 2024 Health Insurance Trends

In 2024, the health insurance industry experienced significant changes. We've seen firsthand how rising costs in the marketplace have impacted both...

Is Nomi Health Right for Your Business?

Disrupting today’s healthcare landscape, Nomi Health eliminates the middleman and provides employers with increased control and transparency over...

Is A Captive Right For Your Organization?

If you’ve ever explored self-funded health plans, you may have heard of “captives”, but you might not fully understand how they function or what...

J&J Sued Over Contracting with PBM that Overcharged Health Plan, Enrollees

A new area of potential liability for employers was recently opened when a class-action suit was filed against Johnson & Johnson (J&J),...

Plan Terms – and Their Various Definitions

In early February 2024, news broke of a proposed class action lawsuit against Johnson and Johnson for breach of their fiduciary duty under ERISA,...

Reflections on the Recent Johnson & Johnson Lawsuit

For those of us in the employee benefits world, quite a bombshell was dropped on Monday, February 5th when a class action lawsuit was proposed...

What Truly Defines High-Quality Healthcare?

When looking at messaging and marketing coming from both healthcare providers and health insurance carriers, we see the term “high-quality care” a...

The Shifting PBM Landscape

As we approach January 1st, many employers are yet again seeing increases to the cost of their health plan - an all too familiar product of a health...

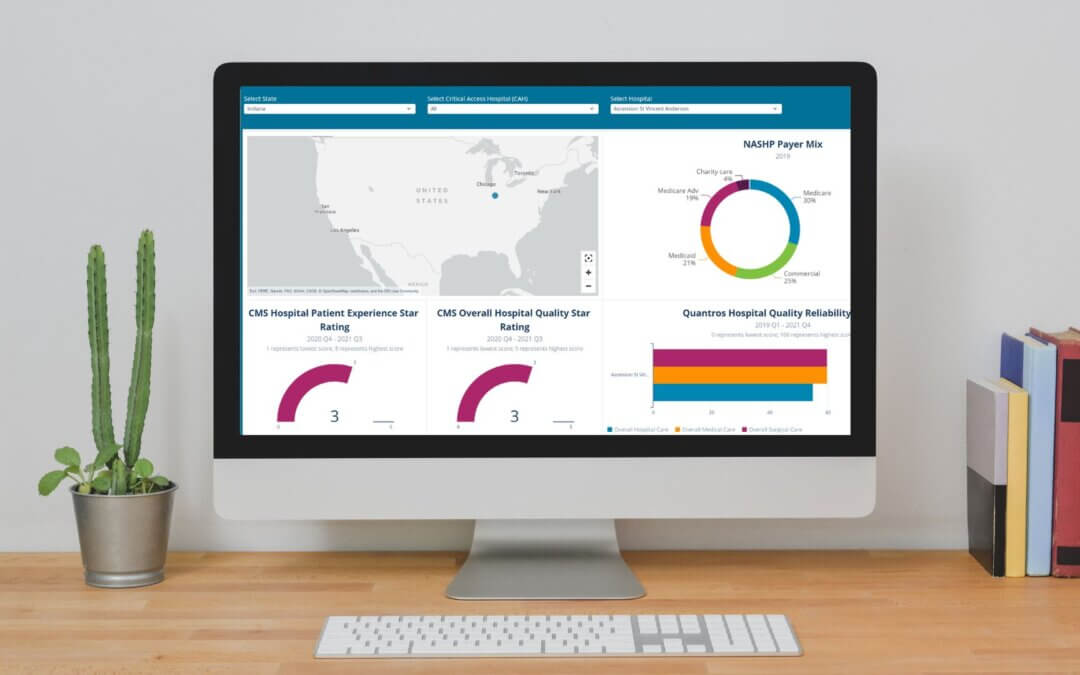

Accessing Healthcare Quality and Cost Transparency

Sage Transparency makes hospital quality information easily and freely accessible. Many of us know the stress that comes from surprise sky-high...

Start a Conversation

Let’s have a conversation on our dime to see if a Total Control Health Plan will meet your business or organization’s goals.

Contact us to schedule a free consultation today.

What is MLR?

MLR, or Medical Loss Ratio, is a prime example of misaligned incentives in the health care supply chain. The Medical Loss Ratio is a provision in the Affordable Care Act that was intended to keep insurance carriers from over charging their customers. It requires that carriers spend $.80 of each dollar collected in the small group market, and $.85 of each dollar collected in the large group market, to pay its customers’ medical claims and activities that improve the quality of care. The remaining portion can be used for overhead expenses, such as marketing, profits, salaries, administrative costs, and agent commissions. If health care costs go up, however, then the carrier is justified in charging higher premiums increasing the value of their 15% or 20%. With a model like this, carriers benefit when health care costs go up.