For those of us in the employee benefits world, quite a bombshell was dropped on Monday, February 5th when a class action lawsuit was proposed against Johnson and Johnson, and specific executives, for breach of fiduciary duty under the Employee Retirement Income and Security Act (ERISA).

At first the news was a bit “ho hum” as we thought to ourselves, “did they pick a high cost mutual fund for their retirement plan again?” But the answer was no, it has nothing to do with the J&J retirement plan. In what may turn out to be a landmark case, the plaintiff is suing J&J and the health plan fiduciaries for “failing to negotiate lower prices for prescription drugs, which cost workers millions of dollars in overpayments for generic drugs”. Bloomberg News reports that, while some large companies and unions have sued their health plan providers alleging that they’ve breached fiduciary obligations, the case against J&J may be the first case by an employee making those claims against a prominent company.

Why We Anticipated This

At TCHP, along with those who also believe in well managed health plans, we have seen this day coming for the following reasons:

- ERISA applies to Welfare Benefit Plans, along with Retirement Plans, and Retirement Plan fiduciaries have already taken a beating in the courts related to excessive fees in retirement plans.

- Health Plans are Welfare Benefit Plans, and there are so many examples of overspending and price gouging in a traditional health plan that it was only a matter of time before an employee spoke up.

The lawsuit, which provides numerous, jaw-dropping examples of over-paying for prescriptions to the detriment plan participants, is largely focused on the failure of the plan fiduciaries to effectively vet their Pharmacy Benefit Manager, Express Scripts, and to hold them accountable. In the wake of the release of the proposed suit, there has been significant speculation as to whether it will hold up to scrutiny, or if it will be dismissed as Johnson and Johnson believe.

What Does This Mean For Employers?

Regardless of the outcome of this particular case, we believe this could mark a turning point for health plan fiduciaries and we encourage you refresh your memory on your obligations under ERISA. To help with the process, we are recommending the following resources for your review:

- The highly detailed lawsuit is an interesting read.

- The website, The D&O Diary, has a very good summary of the suit and clearly outlines the challenges it faces moving forward.

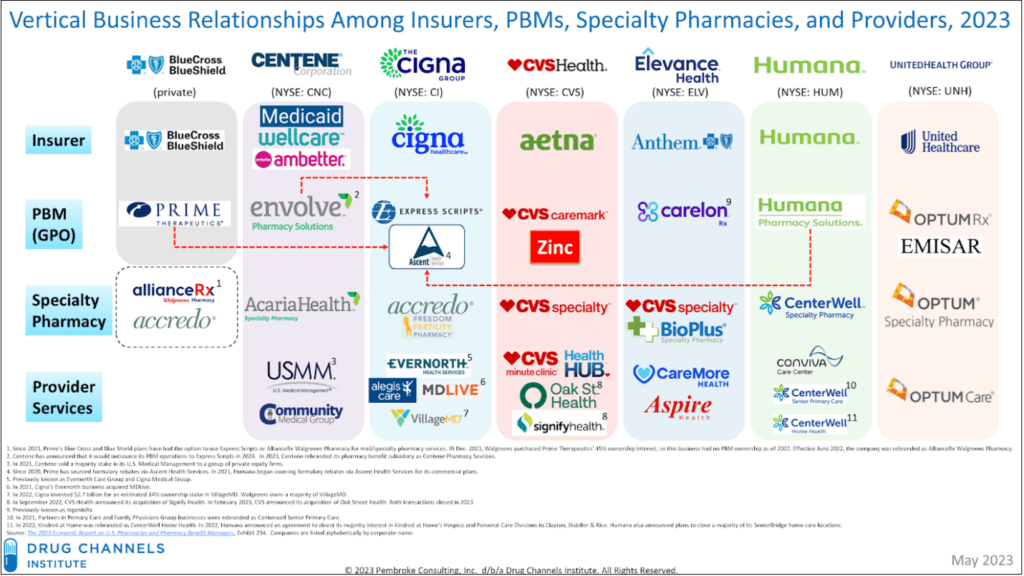

Finally, our recent blog highlights examples from different PBM contracts that we have reviewed and/or negotiated on behalf of employers to provide insight into where seemingly innocuous contract provisions can have a major impact on plan costs. It is important for plan sponsors to understand that even though the market is dominated by three big players, they have many different options to choose from.

An Overview of the Current PBM Marketplace

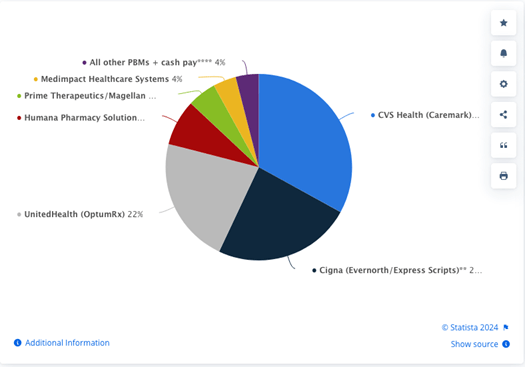

There are approximately 70 PBM’s in the market today, which is dominated by three big players:

- CVS Caremark – 33% market share

- Express Scripts – 24% market share

- OptumRx – 22% market share

When the three next biggest are added to the pie, the remaining 64 PBM’s only represent 4% of the market.

The biggest takeaway is that we believe it is going to be increasingly important for plan sponsors to have a good understanding of who is getting paid what within their plans. The low hanging fruit is the pharmacy portion of health plans and there are many more places to look in a PBM contract than just those highlighted here.

We would be happy to review your contract with you to point out areas for improvement – give us a call today!